Don’t give up on risk parity just yet, argued Cliff Asness in his latest blog post.

The AQR founder defended the recently maligned strategy, explaining away recent performance as part of normal market movements.

“This has been a long and painful relative period for risk parity,” Asness wrote. “But it has not been one that’s historically unprecedented or even unusual.”

Risk parity is designed to offer an edge over “a more traditional equity-dominated allocation,” Asness said, through superior diversification. But, he argued, “better diversification and a modestly higher Sharpe ratio does not always win.”

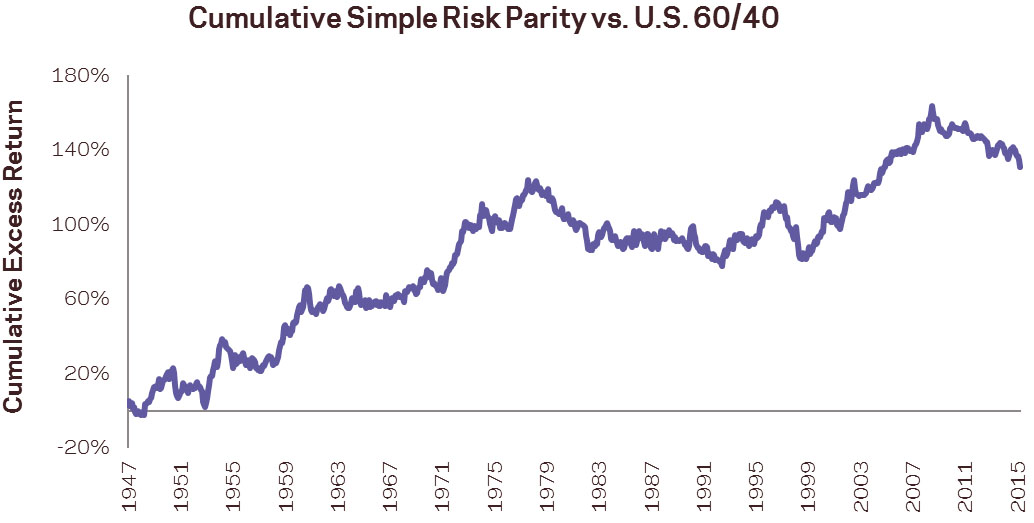

Therefore, Asness wrote that it is important to keep a long-term perspective when examining performance. In absolute terms, Asness found that risk parity strategies have grown steadily since 1947, despite drawdowns along the way, with cumulative excess returns reaching 500% by 2015.

“Drawdowns in real life always seem to feel longer and induce more pain than you’d imagine looking back,” Asness wrote. “This is true for risk parity and all of investing.”

Risk parity’s relative performance compared with a 60/40 allocation was less stellar, but still positive, due to “better diversification, in particular making assets like bonds and commodities count as much, but not more than, equities,” Asness wrote.

Recent losses, meanwhile, were caused by a strong equity bull market, a sharp downturn in commodities, and the superiority of US stock market performance over the global equity portfolio implemented by risk parity approaches.

“While recent times have been difficult versus history and versus the zero line, they are well within the bounds of historical experience,” Asness wrote. “While we certainly wish recent times were better for strategic risk parity, we don’t see any evidence that would change our long-term view.”

While it may be challenging to hold onto what seems to be a losing strategy, Asness argued that investors need a better reason to deviate than the realization of “painful results that we, unfortunately, expect to see from time to time.”

“Deciding what is reasonable, allocating to it, then sticking with it… is one of the hardest but most important parts of our jobs,” Asness concluded.

Source: AQR’s “Putting Parity Into Perspective”

Source: AQR’s “Putting Parity Into Perspective”

Related: The Difficulty of Being Right Twice & Risk Parity Smiles Through Market Correction