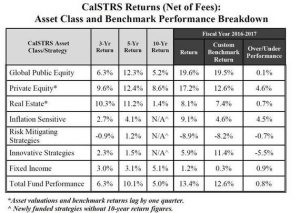

The $208.7 billion California State Teachers’ Retirement System (CalSTRS) system fund generated a 13.4% return net of fees for its fiscal year ending on June 30. The fund outperformed its customized benchmark by 80 basis points.

The fund has come back to a double-digit return following three fiscal years of single-digit returns. CalSTRS’ 10-year return is now roughly 2% shy of its 7% targeted return average, reduced from last year’s target of 7.25% in February.

“Just as one bad year will not break us, one good year won’t make us. We intentionally keep our eyes focused on a 30-year horizon and make our adjustments with that timeframe in mind, rather than reactively responding to any given situation at-hand,” said Chief Investment Officer Christopher J. Ailman. “Investment performance over time is the true hallmark and measure of success in a pension fund like CalSTRS, as we aim to achieve long-term value creation to secure the retirement futures for more than 914,000 California educators.”

Global public equity (19.6%) and private equity (17.2%) were key contributors to the fund’s performance, outperforming benchmarks by 1% and 4.6%, respectively. The fund’s worst performing strategy was its risk mitigating strategy (-8.9%), which represents 5.1% of the overall portfolio.

The plan’s RMS allocation acts as a diversifier for the portfolio. This allocation targets investments that tend to have a low or negative correlation to the global equity class, such as long-term U.S. government bonds.

CalSTRS other portfolio holdings included 56.4 % in US and non-US stocks, or global equity; 8.1 % in private equity; 12.6 % in real estate; 1.3 % in inflation sensitive; 0.3 % in innovative strategies and strategic overlay; 14.7 % in fixed income; and 1.5 % in cash.

On April 6, 2017, CalSTRS funded status is 63.7 %.

Tags: CalSTRS, Fiscal Year, Pension, Returns