Cognitive biases and inaccurate stereotypes of female investors need to be shattered to achieve better gender balance in asset management, according to research by State Street.

“Effecting real change will require a cultural shift—reimagining the investment industry’s language and behavior to one that is inclusive of both genders.”The firm said there was an unhealthy “optical illusion, which colors our perception of gender differences”, reinforcing a myth that women investors were less skilled than men—even when there wasn’t evidence to confirm it.

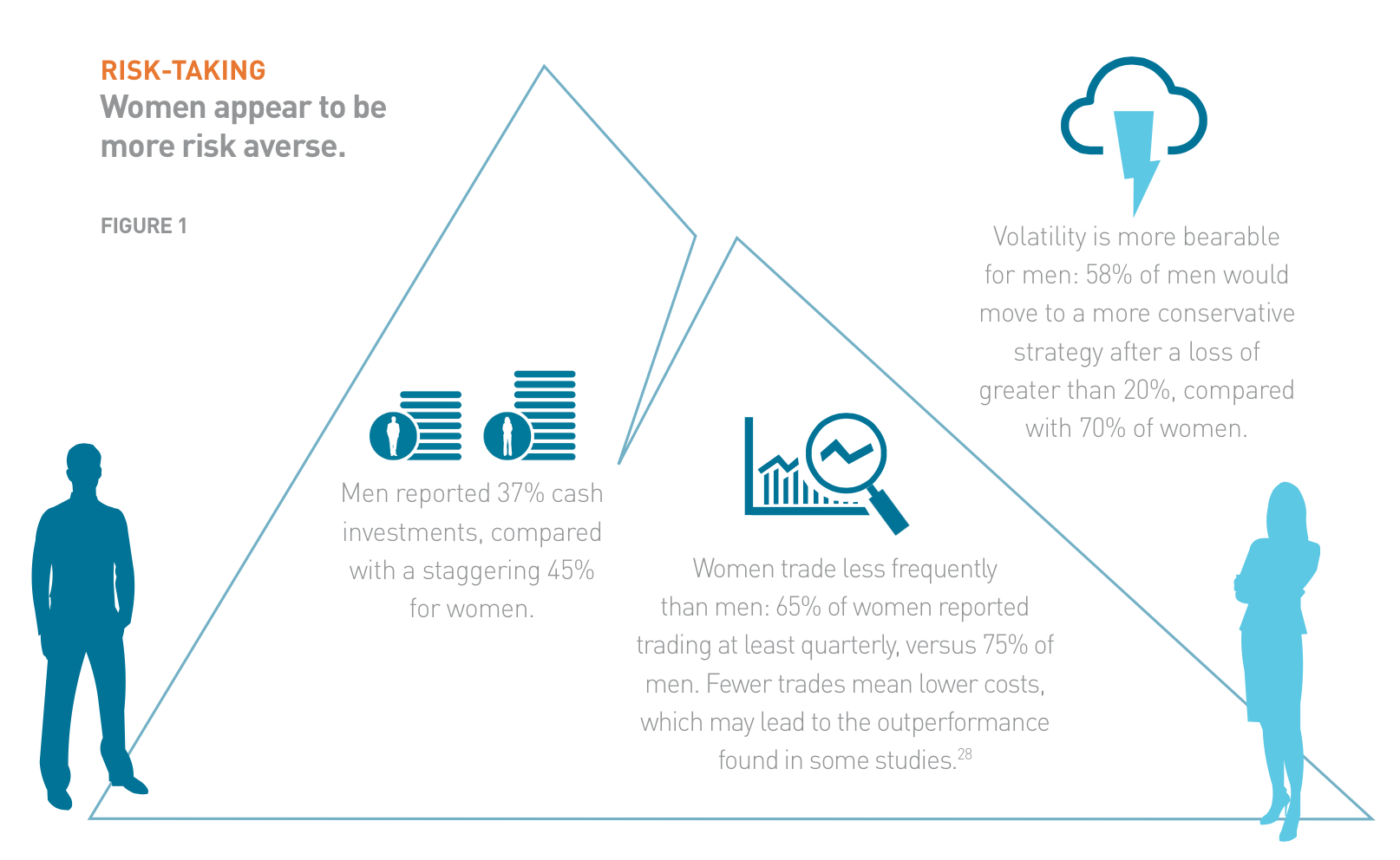

The research—conducted over the last six months—found common stereotypes, such as female money managers being more risk-averse than their male counterparts, were largely untrue.

In fact, when controlling for overconfidence and financial knowledge, risk aversion among women tended to diminish or even reverse in some cases, State Street said.

In addition, the assumption that men make better leaders than women was disproved in one study, in which women outperformed men in five out of nine important leadership characteristics.

Instead, female investors prioritized achieving the long-term goals—more so than men who focused on risk-adjusted returns—and were able to deliver more consistent performance.

The combination of the disparity in perspectives and approaches to investing by men and women could be not only complementary, but also work in synergy, the report said.

“The DNA of portfolio management lies in diversification,” Suzanne Duncan, global head of research for State Street’s Center for Applied Research, told CIO. “Yet, the industry has yet to apply this very idea to the management of talent. And talent is really the bread and butter of the business.”

However, the Boston-based firm said such unconscious forms of “gender folklore” and cognitive biases have become almost inherent in today’s asset management industry, resulting in a severe gender imbalance.

“Effecting real change will require a cultural shift—reimagining the investment industry’s language and behavior to one that is inclusive of both genders,” the report said.

This transition not only involves a move away from a culture of outperformance to one reflective of long-term goals, but also an interruption of gender bias.

State Street found basic changes in hiring, evaluation, or assignments could potentially disrupt biases. One study showed adding “salary negotiable” to a job posting was able to reduce the gender gap in pay by nearly 45%.

Read State Street’s full study, “Addressing Gender Folklore”.

Source: State Street

Source: State Street

Related Content: Video: ‘I’m Not a Sexist; I’m a Capitalist’; The Missing Women of Asset Management; Pointing Out Sexism Isn’t Sexist