Modernizing DC Plans

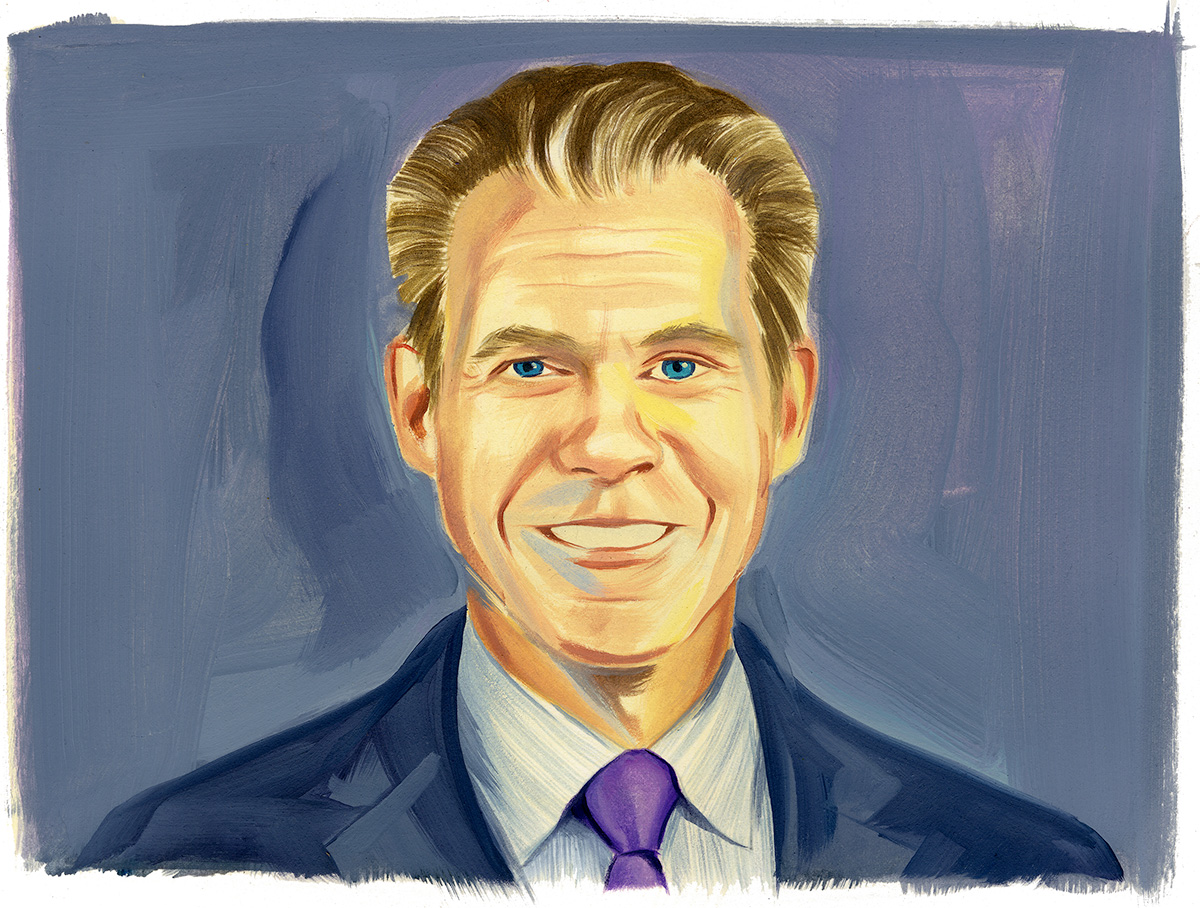

“Where we go as an industry is really the question.”Robert Hunkeler has been with International Paper since 1997 and in pensions since 1988. Over his 30+ year tenure, the asset allocation space has evolved significantly, and within International Paper, Hunkeler has led the way, implementing changes in his retirement plans that put the company ahead of many of its peers.

Hunkeler oversees a legacy defined benefit plan and open defined contribution plans. International Paper closed its defined benefit plans to new entrants in 2004 and froze accruals in 2018. As the focus shifted away from defined benefit, Hunkeler spearheaded an internal effort to modernize the defined contribution plan, improving the investment options available to plan participants. International Paper was one of the first corporations to unbundle its plans to improve options available to participants and cut costs. He tells CIO that he’s worked with his investment team to make the defined contribution plans “a good deal” for participants and create vehicles that he hopes individuals will stick with even after they’ve left the company. On the defined benefit side, Hunkeler led the effort to move to a liability-driven investing (LDI) program and has also de-risked the overall portfolio.

“We think we’ve been pretty forward-thinking in terms of our approach, and we have been able to implement changes ahead of some of our peers on the corporate side,” Hunkeler says. “There’s still a lot of catching up to do within corporate plans.”

Alongside the work to modernize International Paper’s retirement plans, Hunkeler has also built a strong team that will succeed him when he decides to retire. He says it’s important to create an internal culture where everyone knows their role and has a clear path forward. Creating a grounded team will also help as the investment team evolves. The shift to defined contribution plans was the big move during Hunkeler’s career, but the next phase for retirement plans is still largely unknown.

The contour of the defined contribution plan is likely to evolve as investment professionals and retirees continue to look for better solutions. Hunkeler notes that his team is always thinking about how to improve the 401(k) so that it remains responsive to the retirement needs of plan participants.

“Where we go as an industry is really the question,” Hunkeler says. “With a bigger focus on passive investment inside the DC world, it raises questions about the role of the CIO and what the work looks like in the future. It will be interesting to see if we get the same types of people pursuing this career or if that also changes.”

See more here.

-Bailey McCann