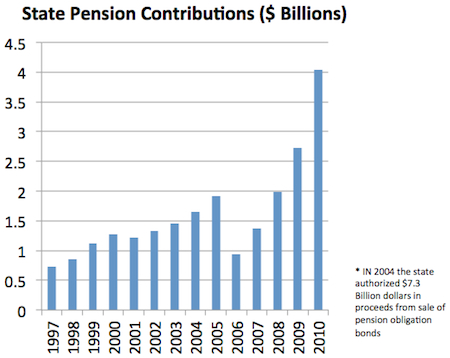

(June 5, 2013) -- In 2005, Illinois lawmakers voted to skip two years of pension payments—which "seemed like a good idea at the time," according to a spokesperson for Illinois Speaker of the House Michael Madigan.

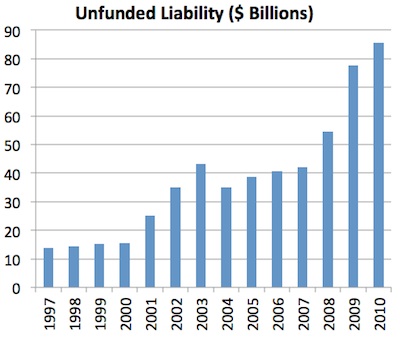

At the time of the vote, the state's pension shortfall was $38.6 billion. Over the last eight years, it has hit roughly $100. Legislators did not achieve a deal or settle on a plan for tackling the state's financial crisis before its summer recess.

Governor Pat Quinn said Tuesday that he would consider the possibility of calling lawmakers back into session to deal with the funding shortfall. However, Speaker Madigan did not show up to the first closed-door meeting with legislative leaders, according to the Chicago Tribune. Madigan's spokesperson Steve Brown defended the speaker's support of the $2.3 billion "pension holiday" and went on to blame the lack of Wall Street regulation for Illinois' pension problems. According to Brown, legislators at the time made these cuts to prevent substantial cuts in education, healthcare, and social services. The speaker is reportedly out-of-state and is not reachable by cell phone, which has left the governor uneasy.

When aiCIO reached out to Illinois Senate President John Cullerton's office, and requested comment as to the effects of the pension holiday. The office immediately hung up.

Fitch Rating Agency citied incompetency and ineffective bureaucracy at the state government as its reasons for downgrading Illinois' credit rating from "A" to "A-." In a statement Fitch said, "the downgrade reflects the ongoing inability of the state to address its large and growing unfunded pension liability, most recently through the failure to pass pension reform during the regular legislative session that ended May 31, 2011." The downgrade will only increase the state's cost of borrowing compounding the underlying financial issues. Moody's and Standards and Poor's have ranked Illinois as the least credit-worthy state in the nation. Although neither agency has yet to follow Fitch's lead, investors are likely to demand higher interest rates to assuage the increased risk. The state plans to issue further bonds as part of their $31 billion capital improvement program.

Governor Pat Quinn's office did not respond to a request for comment by press time. —James Curtin