Asset owners need to redefine the nature of their contracts with alternative managers to achieve alignment of interest, according to research.

Instead of the current norm of limited partnership agreements, investors would benefit from a more relationship-like bond with managers based on trust, transparency, and mutual dependency.

“External fund managers enjoy a disproportionate amount of power relative to the value they actually add in these illiquid markets,” wrote Ashby Monk and Rajiv Sharma of Stanford University. “Too often, the value created by external asset managers is captured by the managers rather than flowing through to the asset owners that back them.”

Specifically, the authors said there is minimal communication between the general and limited partners, usually only including quarterly or semi-annual reporting. Investors also tend to be without approval rights over investments, leaving the bulk of the decision-making to the managers.

The fee structure also “enables the fund manager to share the principal’s award,” the paper said, as they win bonuses for outperformance.

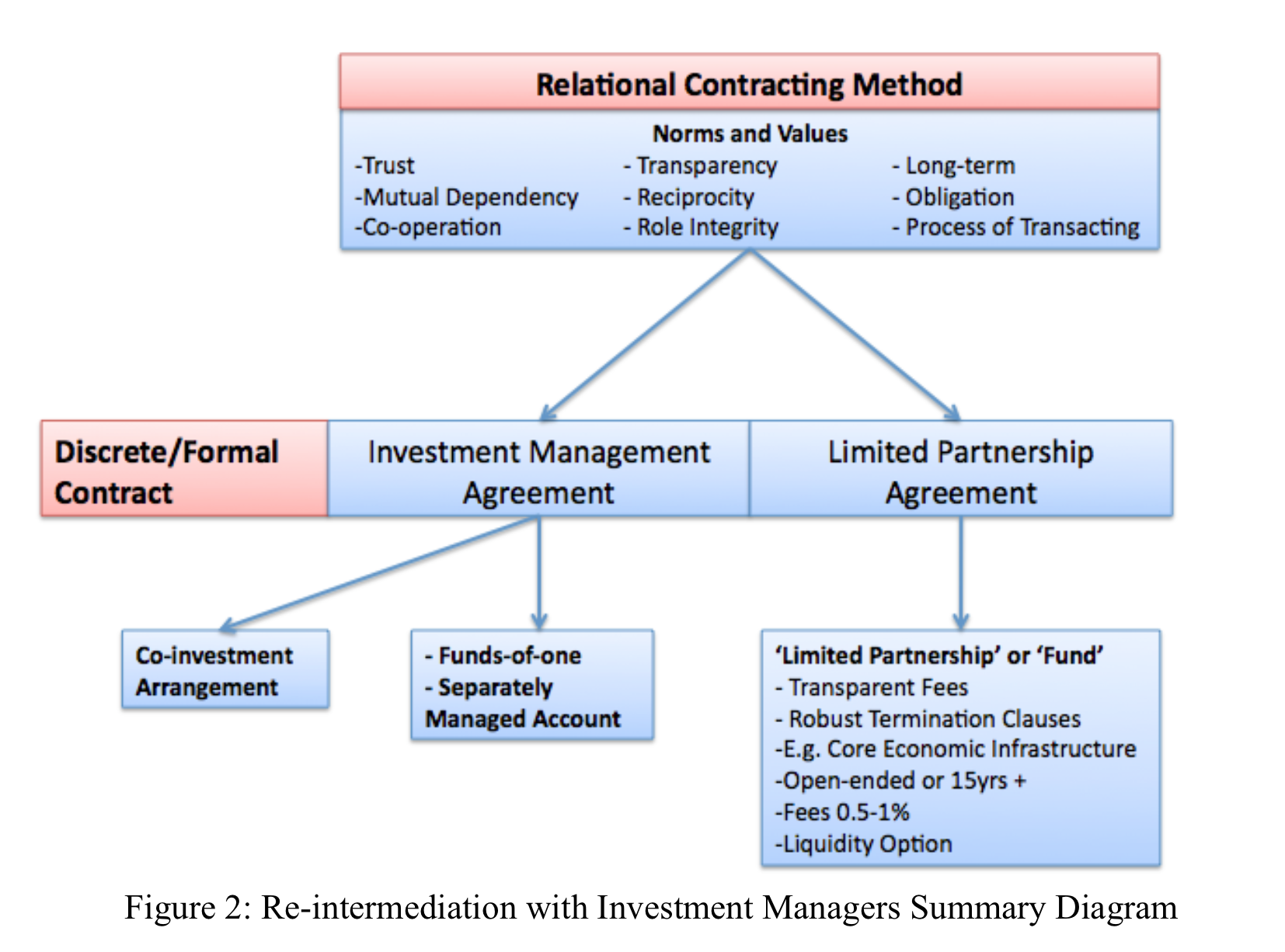

Instead, Monk and Sharma recommended a “relational contract” designed to foster long-term investor-manager relationships based on trust.

Such relationships would require strong governance from general partners “to go above and beyond the bare requirements of the formal contractual terms,” the authors said.

Large asset owners that are able to take advantage of scale and longer time horizon should pursue discrete relationships such as separately managed accounts or co-investments.

These contracts would allow investors to take on more control and responsibility for the success and failure of their investments, the paper said.

Smaller asset owners that are restricted to pooled investments like the limited partnership agreement should push for transparent and discretionary fee structures, the authors argued.

Monk and Sharma added that these investors should also negotiate appropriate and fair terms for termination to ensure accountability and punish managers for behaviors that they “do not deem to be in their interest.”

However, these changes towards a trust-based approach are likely to face major headwinds.

Not only are managers already making large sums in fees from the current system, but the legal terms of ‘limited partners’ and ‘general partners’ may also limit what each party is responsible and liable for.

Consultants could worsen the situation, the authors said, by assuming the role of gatekeepers, preventing managers from developing direct relationships with the investors.

Source: “Re-Intermediating Investment Management”Read

the full paper “Re-Intermediating

Investment Management”.

Source: “Re-Intermediating Investment Management”Read

the full paper “Re-Intermediating

Investment Management”.

Related: The “New Power” of Asset Owners; How Do You Solve a Problem Like Consulting?; STOP. Do You Know What You’re Signing?