Factor-based strategies are no secret, but their value hasn’t yet run out, according to AQR Founder Cliff Asness.

In his latest blog post, he argued that value, momentum, carry, and quality strategies will continue to reap returns going forward, “though perhaps not at the same level and with different risks than in the past.”

“We believe that many strategies make a journey from alpha to a middle ground,” Asness wrote. “This middle ground is a place where they are known, still work, and eventually fall under a set of overlapping labels like alternative risk premia, style premia, priced factors, exotic beta, and of course, smart beta.”

According to the quant expert, these strategies will continue to be attractive because of two qualities: investors will be rationally compensated for taking risks and also make errors.

“A tight value spread should logically lead to lower long-term average returns to the factor going forward. But, lower does not have to mean irrelevant or disappearing.”However, as strategies become known to laymen, investors should anticipate lower expected returns, Asness wrote.

Take long and short portfolios, for example. As a strategy or factor becomes more popular, the “value spread” between the long and the short side is likely to get smaller—or overcrowded.

“A tight value spread should logically lead to lower long-term average returns to the factor going forward,” Asness said. “But, lower does not have to mean irrelevant or disappearing.”

The AQR founder continued that spreads on many factors were tighter now than they have been in the past, “but not shockingly so.” Plus, factors’ value spreads are significantly wider than the valuations of long-only equity and bond markets.

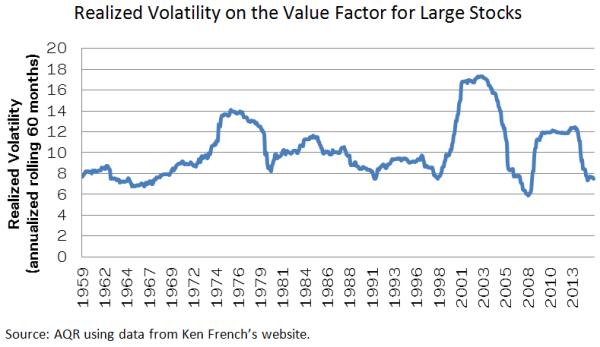

Asness added that there is also an increased risk of a crisis—or a run—on the more popular strategies. These potentially higher outflows “become a new source of day-to-day volatility,” he wrote.

“Even with no change in the long-term average return, we’d expect a somewhat lower Sharpe ratio to a ‘known strategy just from this effect—higher volatility from the additional risk source of flows,” Asness stated.

Despite these expected changes, Asness assured that smart beta—in particular, value strategies—is not yet flooded with capital that would push expected returns to zero and risk to all-time highs.

“Value spreads do not look like ‘the world has changed’ for value,” he said. “Until we see evidence that value spreads are at, and remain at, unprecedented low levels versus history, we see no reason to believe these strategies are so well known that all the expected return is gone from them.”

In an world with so many middle-ground strategies, Asness suggested investors still add these factor strategies to their portfolio as a “truly uncorrelated investment.”

And when they do, they should consider strategies that might be less crowded at the margin; well-constructed long-short versions of smart betas or factors that offer “diversification across themes, geographies, and asset classes”; and not pay “true alpha prices” for known strategies.

Related: Why Too Much Research Produces False Factors & Beware Crowding in Momentum Funds, Says MSCI

Lindel Eakman

Lindel Eakman