Poor liquidity in bond markets could pose problems for risk parity investors at times of market stress, AllianceBernstein has warned.

In a report—“The Bond Liquidity Crunch and What To Do About It”—the asset manager projected that risk parity funds could incur heavy losses if markets sell off in a similar fashion to the “taper tantrum” of 2013.

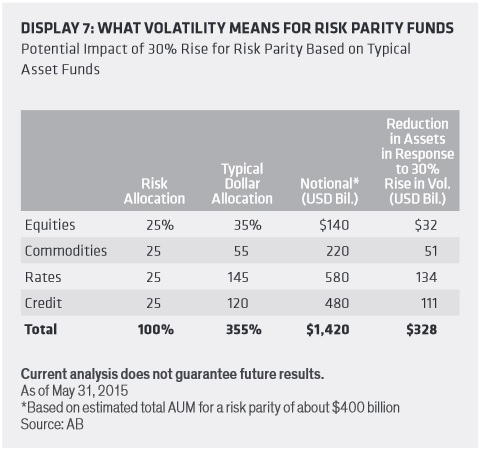

Authors Douglas Peebles, head of fixed

income, and Ashish Shah, head of global credit, estimated the effects of a 30%

increase in volatility on risk parity’s approximate $400 billion in assets

under management.

Authors Douglas Peebles, head of fixed

income, and Ashish Shah, head of global credit, estimated the effects of a 30%

increase in volatility on risk parity’s approximate $400 billion in assets

under management.

With leverage, Peebles and Shah said notional exposure of these strategies was roughly $1.4 trillion. The funds had a $480 billion exposure to credit markets including leverage, they said, meaning losses could hit $111 billion—23% of total exposure in fixed income.

Risk parity relies on the core assumption that correlations between the major asset classes remain negative, meaning that if a 25% risk exposure to equities sees a fall in price, the subsequent rise in bond prices would offset the loss. But this assumption is likely to be challenged more often, the authors said.

“Should correlations turn positive, with stocks and bonds declining at the same time, the risk contribution of each would rise,” Peebles and Shah said. “Managers would then have to sell both to maintain their risk targets. In other words, selling begets more selling.”

Exiting bond positions is particularly difficult, the authors said, as the average trading volume of corporate bonds has fallen drastically in the past eight years: “It now takes 24 days for all outstanding bonds to trade. In 2007, it took just eight days.”

“Funds that operate mechanically with quick triggers have likely already delevered meaningfully… A secondary shock would necessitate materially less model-driven selling.”“Because bonds are inherently less volatile than stocks, risk parity managers must buy them on leverage to equalize the risk contribution of the two assets,” Peebles and Shah added. “Risk parity funds tend to be leveraged anywhere from 200% to 350%, so bond market losses could force a broad sell-off in equities and other asset classes if managers rush to meet margin calls.”

The market sell-off at the end of August put significant selling pressure on equities and fixed income from risk parity strategies, according to analysts at Bank of America Merrill Lynch, as spikes in volatility forced managers to sell down assets to maintain their volatility caps.

However, the analysts said the immediate risk of similar pressures were “much reduced.”

“Funds that operate mechanically with quick triggers have likely already delevered meaningfully,” the bank said, “and coupled with now-elevated volatility levels, a secondary shock would necessitate materially less model-driven selling.”

“The critical assumption embedded in [loss] estimates is that the funds in question operate mechanically,” the analysts added, “and are forced to deleverage relatively rapidly, almost agnostic to market impact. While this is certainly true of some funds, and while volatility target funds as a whole may rebalance more frequently than other risk parity funds, many managers can and do exercise discretion to smooth out their rebalancing.”

Related: Bond Managers ‘Averse’ to Holding Cash Despite Liquidity Fears & GMO: Risk Parity Could Pose Systemic Risk