“It may be a bitter afternoon tea for the British if they decide to vote [leave] at the EU membership referendum on June 23.”

Henrik Henriksen, chief strategist at PFA, one of Denmark’s leading pension providers, likes a stereotype.

Across Europe, investors are waiting nervously as the UK prepares to vote on its membership to the European Union (EU). Across London, deal-making has almost ground to a halt as all involved await the outcome.

The country is eight days away from one of the most crucial events in its recent history—and people are desperately short of answers.

Vote Leave

Why should pension funds be in favor of an exit from the EU?

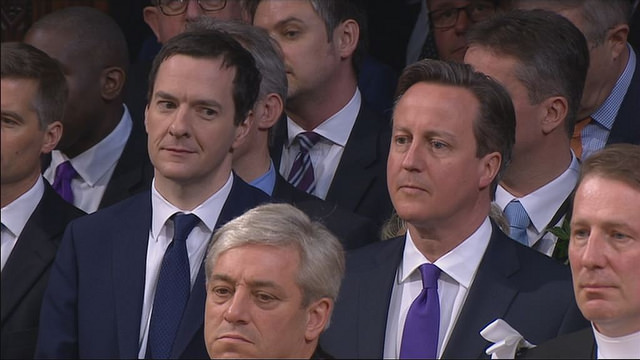

UK Chancellor George Osborne and Prime Minister David Cameron are facing a rift in their party over BrexitIn a report

published last month, the UK’s Society of Pension Professionals (SPP) stated

that “the Brexit vote may represent one of the biggest threats or biggest opportunities

facing UK pensions in a generation.”

UK Chancellor George Osborne and Prime Minister David Cameron are facing a rift in their party over BrexitIn a report

published last month, the UK’s Society of Pension Professionals (SPP) stated

that “the Brexit vote may represent one of the biggest threats or biggest opportunities

facing UK pensions in a generation.”

The pro-Brexit argument from a UK pension perspective largely comes down to regulation—specifically, having less of it. Outside the EU, the UK could opt out of forthcoming rules imposed across the continent, the SPP said. However, other European policies on equality and consumer protection may be undermined.

On the investment side, leaving the EU presents far more uncertainty—and markets don’t like uncertainty.

In the event of what he dubbed “a happy divorce,” PFA’s Henriksen laid out a positive outcome for Brexit. In this scenario—which PFA believes is the most likely outcome of Brexit—“the British will have some time to negotiate a solution about, for instance, cooperation on trade with the EU.”

“We believe risk assets, including stocks and credit, would suffer in the resulting risk-off environment.”“This is a scenario that will result in some negative reactions on the markets, but it is not necessarily something that will affect growth in the long term—neither in Great Britain, nor in the rest of Europe,” Henriksen said. “However, this requires that the politicians have the will to find a pragmatic solution.”

Positive outcomes from Brexit will take longer to materialize, according to a research paper by Maxime Alimi, Eurozone economist at AXA Investment Managers.

“All in, the impact from Brexit is most likely to be negative and small,” she added. From a European perspective, the economic cost of Brexit “looks manageable.”

Vote Remain

The negative impacts will be felt far and wide if the UK does vote to go it alone, according to BlackRock’s Global Chief Investment Strategist Richard Turnill.

“We believe risk assets—including stocks and credit—would suffer in the resulting risk-off environment, as concerns about political instability and a reversing globalization trend would lead to higher risk premiums,” Turnill said.

Peripheral Europe, global financial companies, and materials stocks “would be particularly exposed” according to BlackRock’s analysis.

A form of trade agreement could be reached “with a few creaks in the joints” and lower UK growth, Henriksen said, outlining an “unfortunate” outcome. Alternatively, “the worst case scenario is that other countries will follow Britain out of the EU, resulting in a break-up of the European collaboration and the euro currency,” the strategist said.

“It is difficult to predict how negatively the markets will react, but it will be a mess, and we will definitely be looking at a significant decline on all types of high-risk investments as well as a substantial downturn for the British economy,” Henriksen added.

Fixed income and currency markets are already giving a sneak preview of what may happen if the UK votes to leave. Yesterday, yields on German 10-year government bonds dipped into negative territory for the first time. This was “definitely Brexit driven,” according to TwentyFour Asset Management CEO Mark Holman.

“Whilst it is very difficult to predict what may happen in the aftermath of a vote to Brexit, we thought that a move of 100 basis points wider in credit spreads in the aftershock was likely,” Holman wrote in a blog post. “If that is correct, then we have seen a good part of the Brexit move already in bond spreads.”

Bond prices may be pushing higher, but equities are suffering: European equity funds have seen outflows for 18 straight weeks, according to Bank of America Merrill Lynch, while UK equity funds experienced net withdrawals in 12 of the past 14 weeks.

It’s all getting rather heated in Europe—and there is still a week to go before the vote.

Related: The Pension Pros (and Cons) of Brexit & What Brexit Means for Real Assets